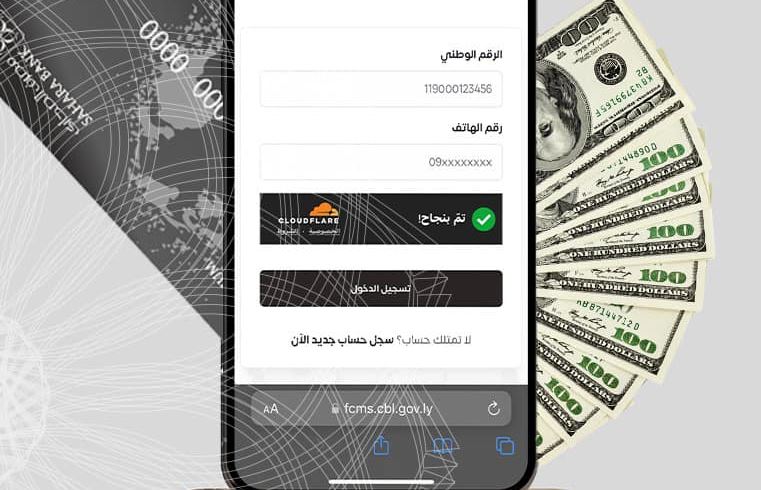

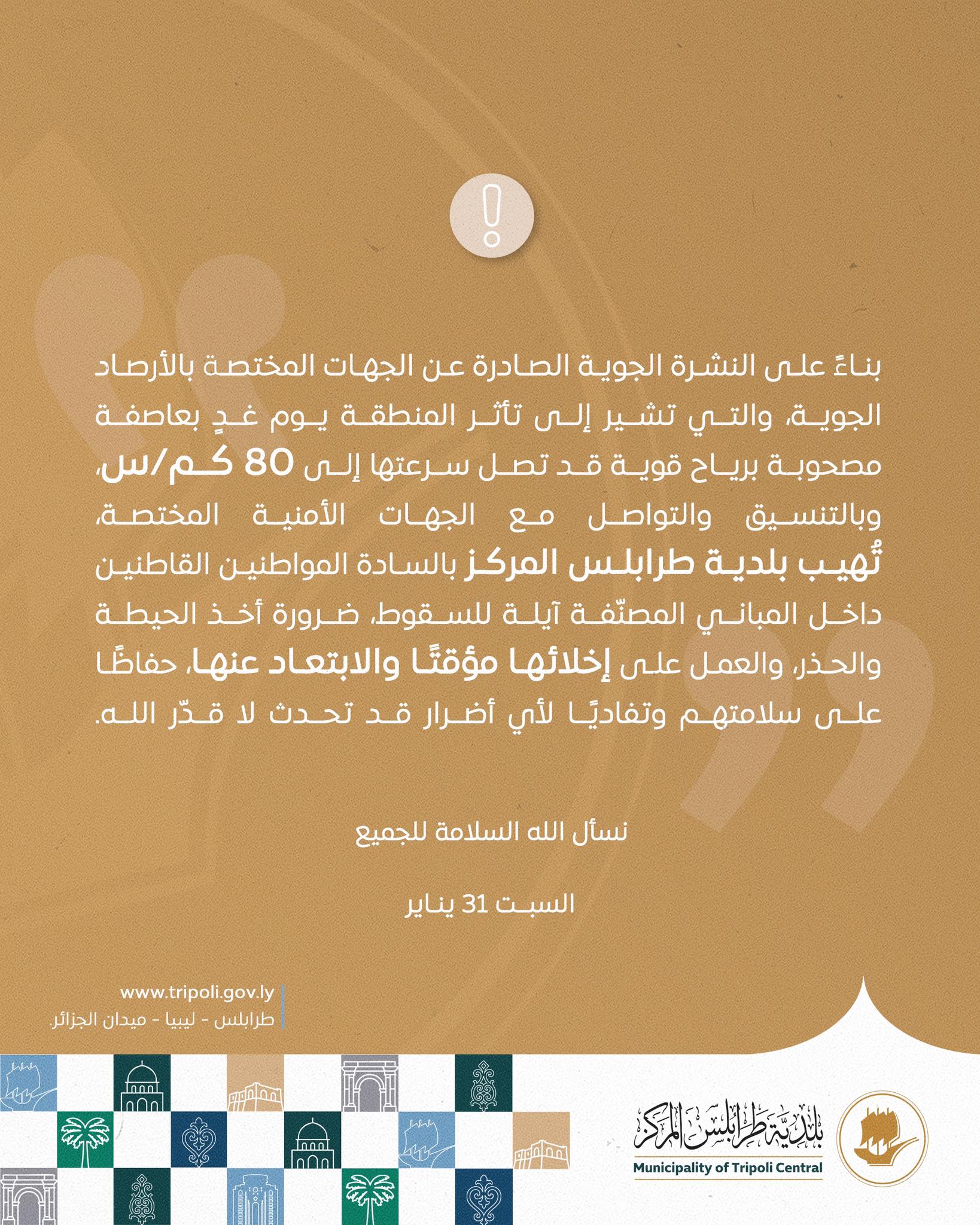

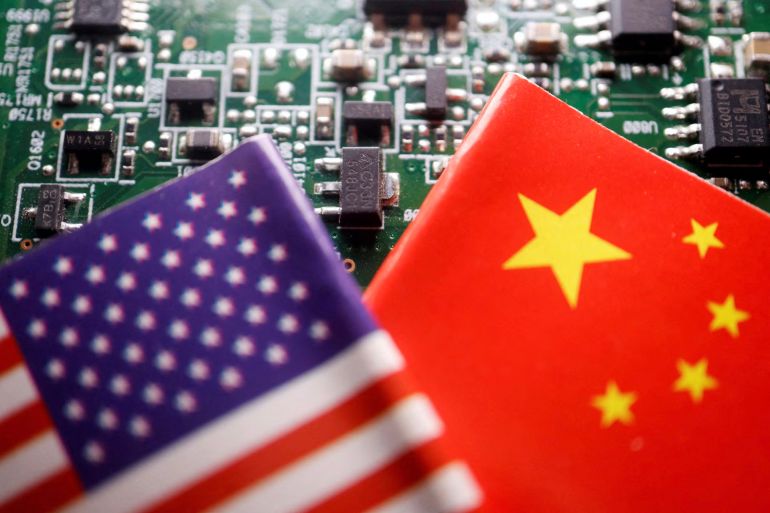

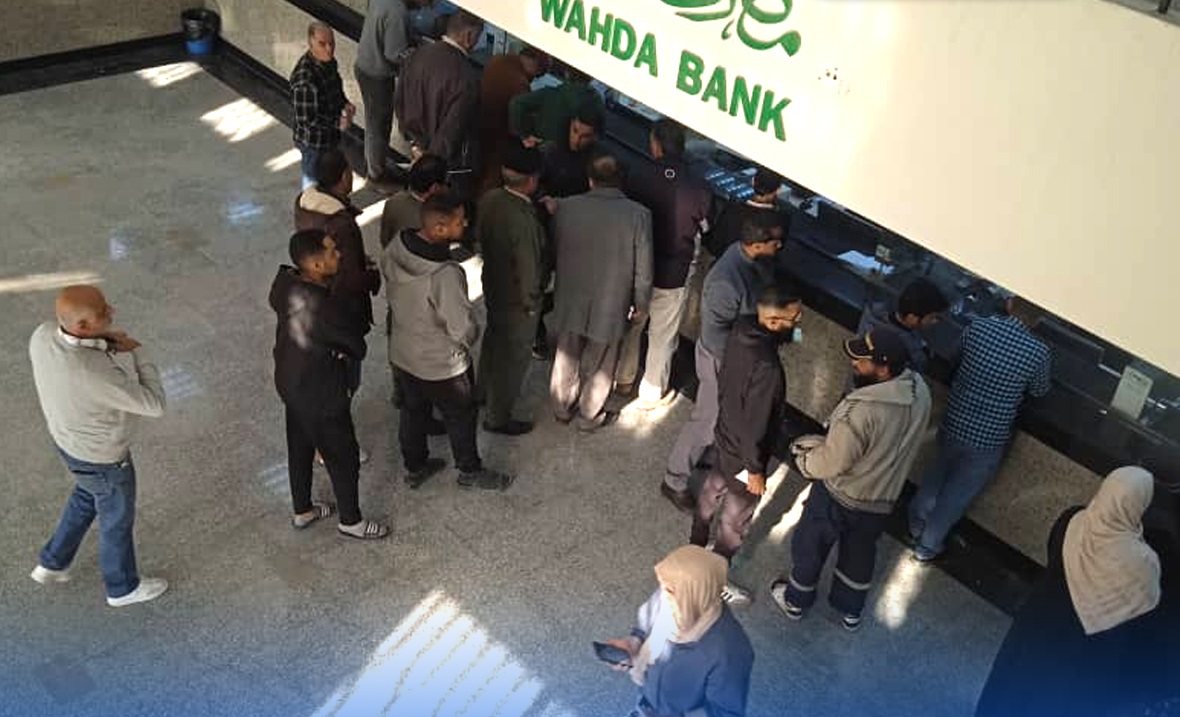

Tripoli | In a move aimed at calming the parallel exchange market and providing foreign currency liquidity, the Central Bank of Libya announced the actual commencement of selling one billion US dollars to commercial banks this Sunday, confirming that work is underway to settle the remaining amounts successively.

Execution of Reservations: Will it be Full or Partial?

A state of cautious anticipation prevails among holders of documentary credits and applicants for pending personal purpose grants, with the main question focusing on the execution mechanism:

-

Fears of Partial Execution: Suppliers and citizens fear that the current injection may be allocated to cover only a portion of the accumulated reservations, which could keep pressure on the Libyan dinar.

-

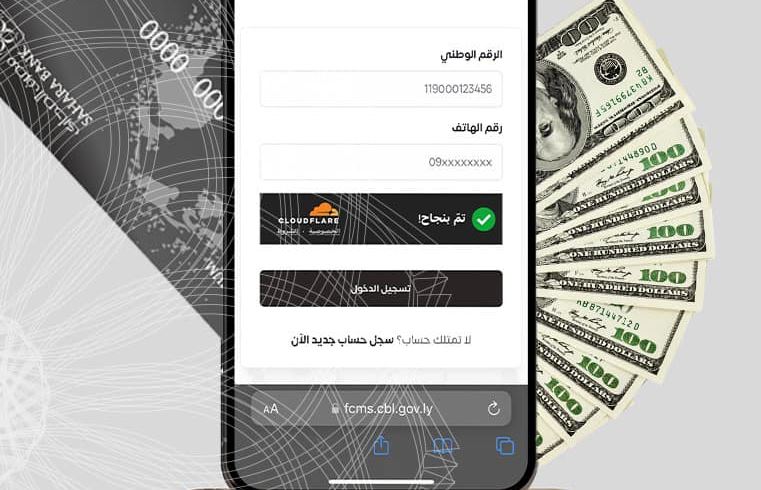

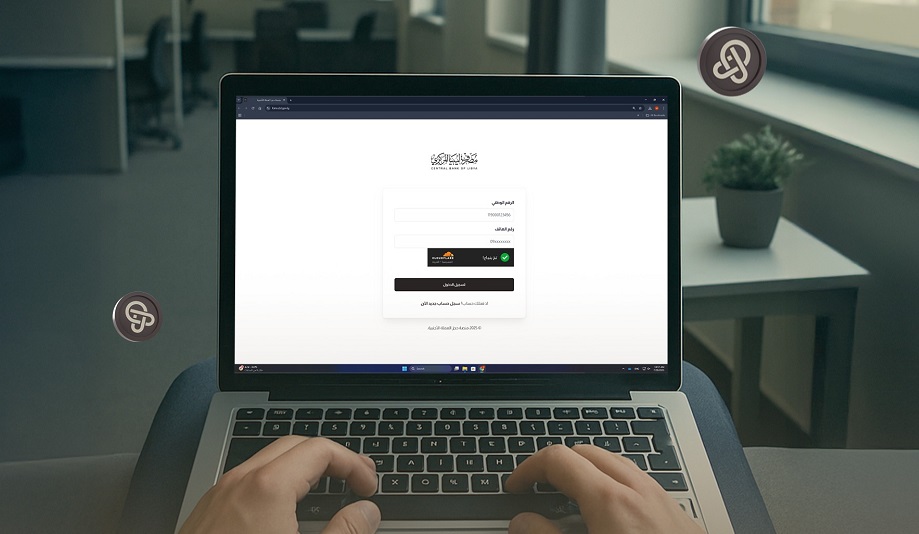

Awaiting Bank Announcements: Attention now turns to the “commercial banks” to issue decisive statements clarifying their readiness to execute all reservations made through electronic systems in the past period.

A State of Anticipation for Opening “Personal Purposes 2026” Allocations

Parallel to the injection process, the Libyan public awaits an official statement from the Central Bank announcing:

-

Opening 2026 Allocations: Starting to receive applications for “Personal Purposes” for the new year.

-

Determining the Grant Ceiling: Will the ceiling remain at $2000 or will it see changes according to new monetary policies?

-

Foreign Currency Tax: The extent of the impact of continuing or amending the fee (tax) on the final dollar value for the citizen.

Analysis: The Impact of the Move on the Parallel Market

Experts view the injection of one billion dollars as a reassuring message to the market, but true stability depends on the regularity of execution and ensuring no time gaps occur between opening the system and the actual deposit into accounts. Furthermore, the announcement of the 2026 allocations will play a fundamental role in withdrawing monetary mass from the parallel market and reducing the price gap.

Summary: The coming hours are critical; either banks will announce a full breakthrough for all reservations, or the market will remain in a state of “caution” awaiting clarity regarding the new year’s allocations.