Lebanese Prime Minister Nawaf Salam announced a long-awaited draft law, demanded by the international community, to distribute financial losses between the state, banks, and depositors affected by the country’s economic collapse since 2019.

In an address to the Lebanese people broadcast on television on Friday evening, Salam stated that this project constitutes a roadmap for exiting the economic crisis that has shaken the country since 2019. It is one of the reforms required by the international community for financial support to Lebanon.

The financial gap law is seen by some as a crucial step for restructuring Lebanon’s debt.

The Council of Ministers is scheduled to begin studying the draft law starting next Monday before referring it to Parliament.

This project, known as the “Financial Gap Law,” represents a fundamental and long-awaited step for restructuring Lebanon’s debt following the unprecedented crisis that deprived Lebanese citizens of their bank deposits.

The draft law is also a cornerstone of financial and economic reform, as it regulates the distribution of losses between the state, the Bank of Lebanon, commercial banks, and depositors. The international community, particularly the International Monetary Fund (IMF), demands its approval as a prerequisite for providing financial support to Lebanon.

Depositors to withdraw $100,000 over 4 years

Depositors who lost access to their funds will be able to recover up to $100,000 over a period of four years, according to Salam, who noted that 85% of depositors have accounts valued at less than $100,000.

As for large depositors, the remaining portion of their deposits will be compensated through asset-backed bonds.

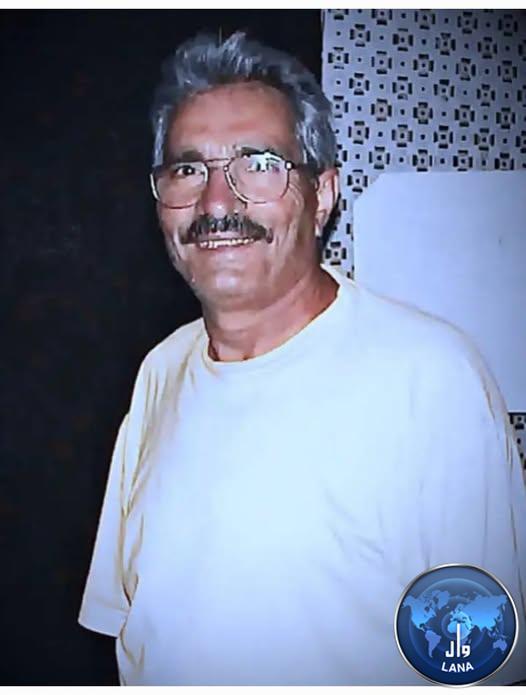

The Prime Minister said: “I know that many of you listening today have hearts filled with anger—anger at a state that left you alone, anger at a system that did not safeguard your money, and at promises that were not fulfilled.”

He added: “This draft law may not be perfect, and it may not meet everyone’s aspirations, but it is a realistic and fair step on the path to restoring rights and stopping the collapse.”

IMF: Draft law is necessary for the benefit of the banking sector

Earlier, the International Monetary Fund (IMF), which closely monitored the preparation of the project, emphasized the necessity of restoring the banking sector’s viability and protecting depositors as much as possible.

In contrast, the banking association criticized the project, considering it to contain serious flaws and impose heavy burdens on commercial banks.

Financial losses estimated at around $70 billion

The government estimates the financial losses at around $70 billion, an estimate that experts say has increased after six years without solutions to the crisis.

It was noted that “banks are angry because the law opens the door for them to bear part of the losses,” indicating that they would have preferred the state to bear responsibility for this financial deficit.

The project stipulates the recapitalization of troubled banks, and state debts to the Bank of Lebanon will be converted into bonds.

Will the law close the door on the parallel economy?

The Prime Minister explained that the law also aims to reform the collapsed banking sector, which had made way for a parallel economy based on cash transactions that fuel smuggling networks.

Parliament approved a banking secrecy reform law last April. Following the election of Joseph Aoun as President of the Republic, legislators approved a law in July to restructure the banking sector, one of several essential legislations for reforming the financial system.

The draft law stipulates that officials and major shareholders in banks who transferred large sums abroad since 2019, at a time when Lebanese citizens could not access their accounts, will be required to return these funds within three months under penalty of fines.

Political obstacles to economic reform

However, the project faces political challenges, according to economic sources. It is supposed to be referred to Parliament for approval, where it may encounter obstacles, as officials and MPs have previously obstructed similar reforms demanded by donor entities.

It was reported that a large number of MPs are directly involved, either as large depositors, shareholders in banks, or political allies of bank owners, and they are not inclined to approve a law that might anger banks or depositors.

In recent years, politicians and bankers have repeatedly obstructed reforms required by the international community. Since assuming power, Presidents Aoun and Salam have pledged to put reforms on the path to implementation and to pass the necessary laws