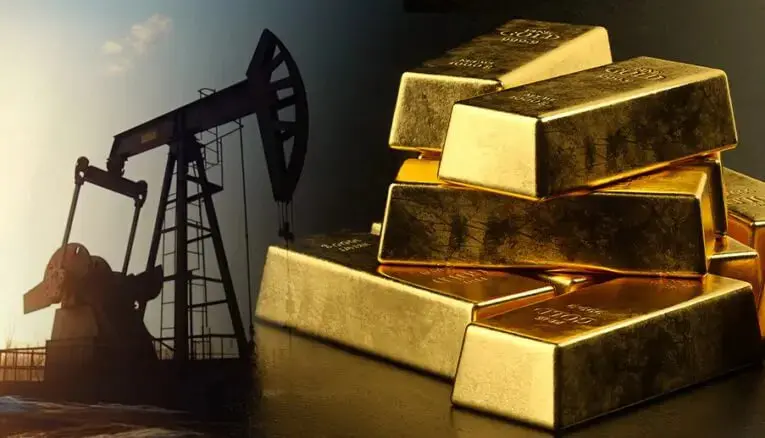

The record-breaking rise in gold prices is sparking widespread interest and growing concerns, particularly on social media platforms, amid an unprecedented rally in precious metals markets against a backdrop of global political and economic turmoil.

Prices for gold, silver, and platinum hit new record highs today, Friday, driven by declining confidence in US assets, coinciding with escalating geopolitical tensions and ongoing global economic uncertainty.

The global gold price is approaching the $5,000 per ounce barrier for the first time in history, registering a jump of around 15% since the first weeks of the new year.

Spot gold rose by 0.4% to reach $4,956.6 per ounce by 07:30 GMT, after touching a record high of $4,967.48 earlier in the trading session. Meanwhile, US gold futures for February delivery increased by 0.8% to $4,956.8 per ounce.

Expectations of US interest rate cuts play a pivotal role in supporting gold prices, alongside a decline in the dollar’s value. This has boosted global demand for the yellow metal amid eroding confidence in the US currency and declining real yields on bonds.

As gold prices continue to climb to record and historic levels, the debate has quickly moved to social media platforms, where users see the current rally as reflecting accelerated shifts in the global political and economic landscape, not merely a response to positive market news.

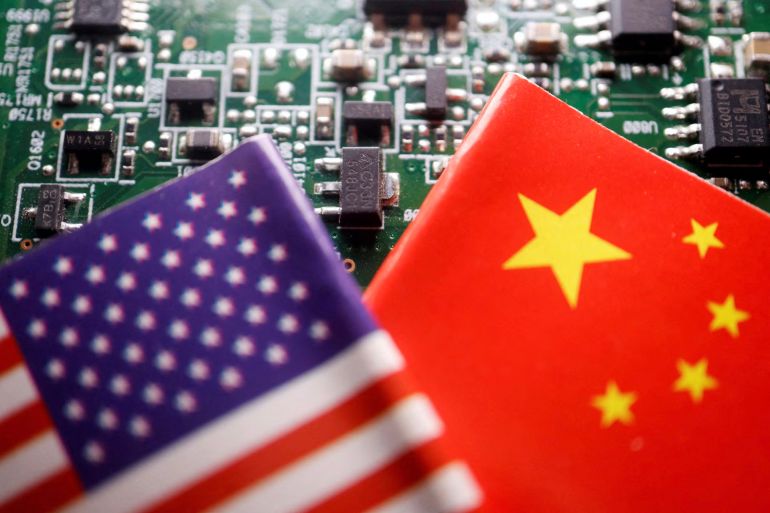

Observers pointed out that gold continues to gain amid declining confidence in the near-term return of political and financial stability. They emphasized that recent international tensions have re-highlighted the role of money as a tool of pressure in relations between nations, especially with the escalation of economic disputes between major powers.

Users explained that US bonds represent one of the most prominent instruments of power in the global financial system, and that merely hinting at using them as a pressure tool, even without direct steps, could negatively impact market stability. This, in their opinion, is driving investors towards gold as a safe haven.

Commentators highlighted the announcement by Goldman Sachs raising its gold price forecast to around $5,400 per ounce. They considered the importance of the move lies not only in the figure itself but in the speed of the estimate revision, reflecting the acceleration of economic variables and the difficulty of predicting market trajectories using traditional models.

Others noted that what is striking in the current phase is the growing demand for gold purchases from the private sector alongside central banks. Gold is no longer viewed as a short-term speculative tool but as a long-term hedging instrument, which has contributed to raising price support levels.

Conversely, some activists believe gold prices may experience temporary correction periods if geopolitical tensions ease or if central banks move towards tightening monetary policies, affirming that the price trajectory will remain contingent on developments in the global economy.

Observers consider that the increasing competition between central banks and large investors for gold, amid limited supply, strengthens the likelihood of the upward trend continuing in the coming period, without guaranteeing that prices will reach specific levels, given the prevailing uncertainty in global markets.