Economic experts predict that the price of gold could reach five thousand dollars per ounce by next March, amid the continuous decline in US interest rates and geopolitical changes in the United States and the world.

The precious metal has recovered what it lost during the sharp decline in late October last year, returning to record territory. It reached a new record level on December 29, capping its strongest year since 1979, after a 64% rise in 2025 and gains of about 140% since the beginning of 2023.

Strategists noted in a memo on Saturday that gold reached new record levels in late December, driven by demand for real assets amid a weak dollar, geopolitical tensions, institutional uncertainties, and low seasonal liquidity.

Declining Interest Rates Benefit Gold

Despite the scale of the recent rise, the fundamental backdrop is still seen as supportive for further gold gains in 2026.

Experts point to a sharp decline in US real interest rates, described as “the opportunity cost of holding non-yielding assets like gold,” which are now at their lowest level since mid-2023.

Record Demand for Gold from Investors and Central Banks

Demand from investors and central banks remains near record levels, while concerns about rising government debt across advanced economies continue to support interest in gold as a store of value. These factors justify expectations for new record levels next year.

Experts wrote: “Our view on gold remains positive,” pointing to the possibility of reaching five thousand dollars next March, adding: “We believe gold’s role as a diversifier and hedge has not diminished. For investors with an inclination towards this asset class, we believe a mid-single-digit percentage allocation to gold can fit within a diversified portfolio.”

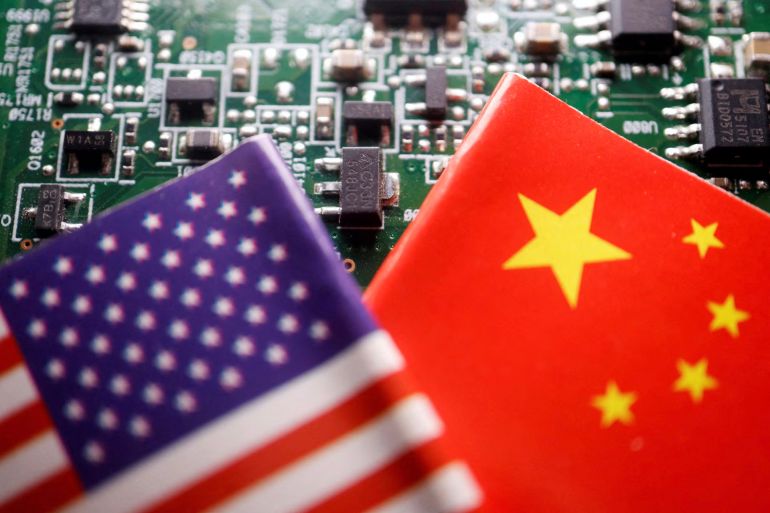

Maduro Kidnapping Supports Yellow Metal Prices

Recent geopolitical events have reinforced gold’s defensive characteristics, particularly after the United States’ kidnapping of Venezuelan President Nicolas Maduro, which triggered a broad reaction across markets.

Gold and silver prices rose 2.2% and 4.3% respectively on the day of the kidnapping operation a week ago, while Brent crude fell 1.3%.

Experts expect central bank gold purchases to reach between 900 and 950 metric tons in 2025 statistics, slightly below the previous year’s record.

Total global gold demand is also likely to be around 4,850 metric tons, which would be the highest level since 2011.