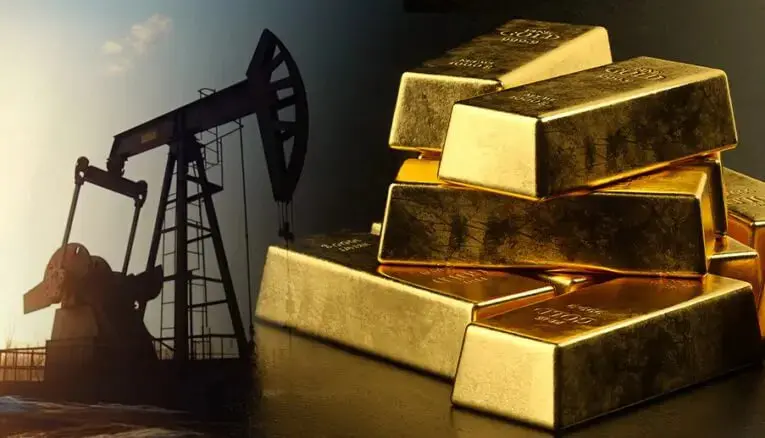

Oil prices have experienced notable volatility as markets assess the implications of the arrest of Venezuelan President Nicolas Maduro and its impact on global oil supplies.

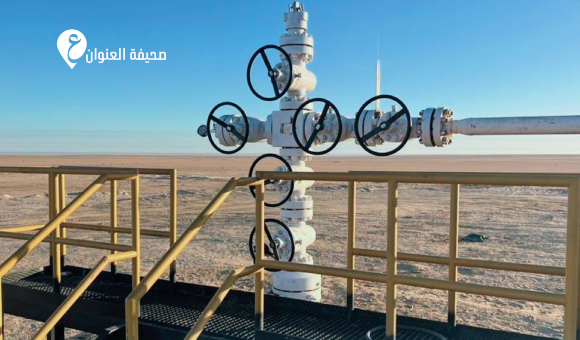

Brent crude opened the trading session with a 1.2% decline, before paring losses and trading near $61 per barrel, while West Texas Intermediate crude stabilized around $57 per barrel.

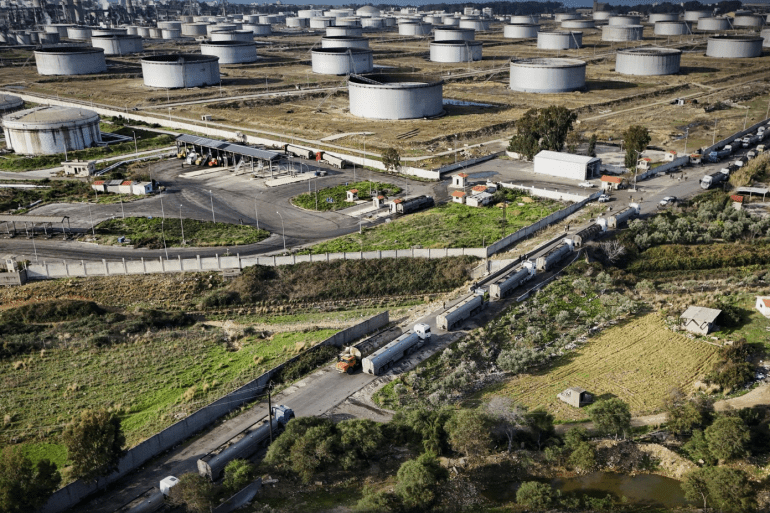

Despite recent turmoil in Venezuela, the country represents a limited portion of global oil supplies, with its current production not exceeding 1% of global output. Most of its volumes are exported to China, which reduces the impact of political events on the international market.

Markets are witnessing a growing supply surplus as the “OPEC+” alliance continues to add more barrels. Despite economic and political pressures on Venezuela, other producing countries can compensate for any temporary production shortfall, reducing the likelihood of a long-term impact on oil prices.

In this context, it has been noted that the market may see an increase in global supplies next year, which could lead to prices falling to around $50 per barrel.

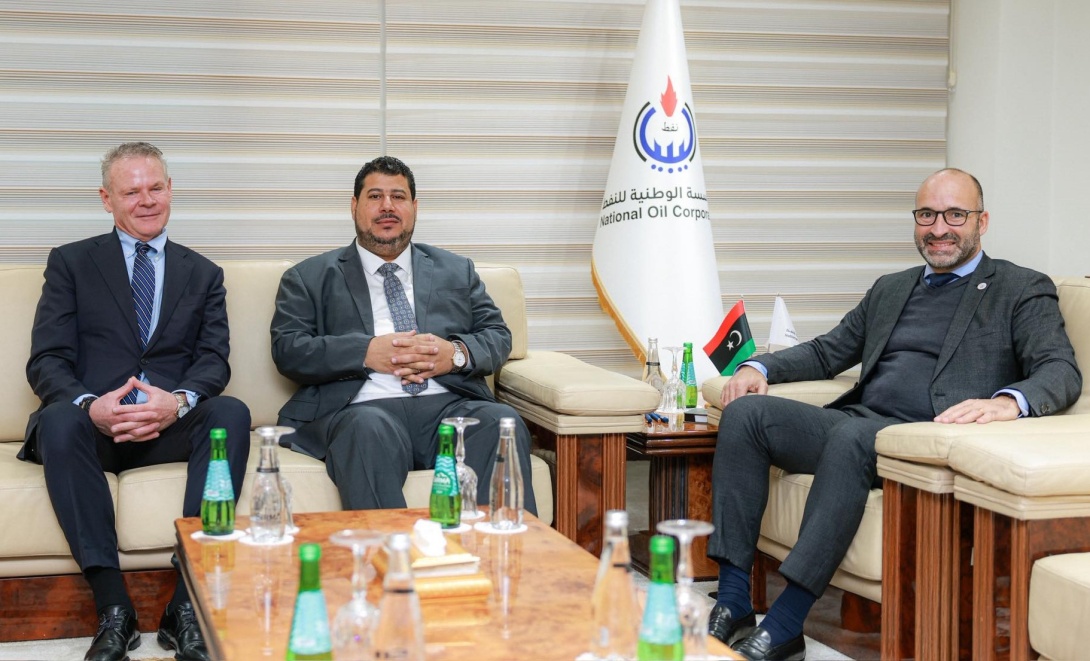

“OPEC+”, which includes member states of OPEC and a number of non-OPEC producers, has announced its commitment to plans to freeze production increases during the first quarter of 2026. The impact of events in Venezuela on the alliance’s policies has not been discussed due to the unclear situation.

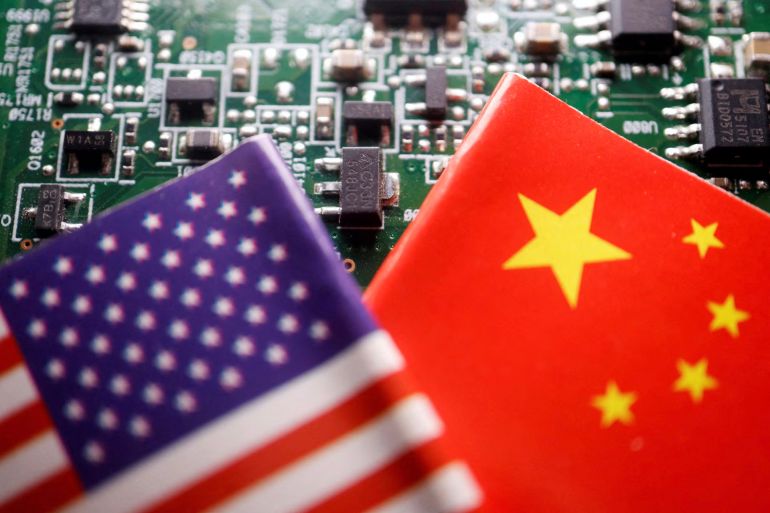

The United States continues to exert pressure on the Venezuelan regime through sanctions on the oil sector, which has forced some companies to reduce their production.

The U.S. President has confirmed that sanctions will remain in effect, with American companies prepared to assist in rebuilding Venezuela’s oil infrastructure, a process that may take a long time.

In statements, the U.S. Secretary of State affirmed that the United States will continue to use its influence in the oil sector to support change in Venezuela.

Despite political tensions, the oil supply surplus remains the main factor influencing prices. It has been explained that the current surplus outweighs geopolitical risks, placing a ceiling on oil prices in the near term.