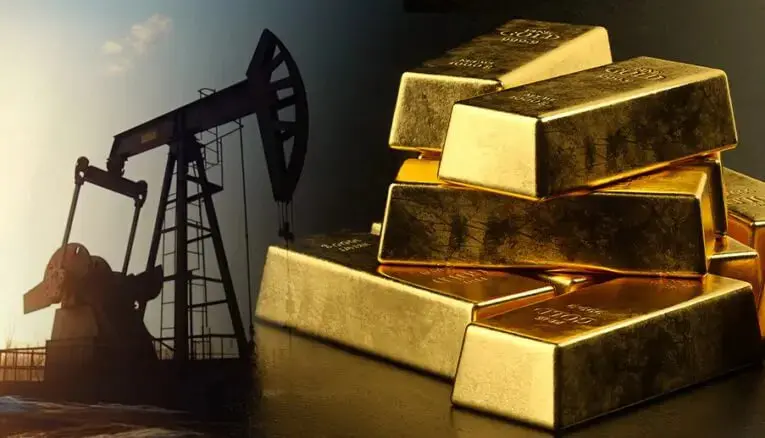

While investors have long looked to gold as the primary safe haven, silver has emerged from the shadows to steal the spotlight. This metal, often nicknamed “the devil’s metal” due to its sharp volatility, recorded historic leaps in 2025 that rattled markets and redrew the map of precious metals, driven by a rare mix of supply shortages and a surge in investment and industrial demand.

On December 12, 2025, the price of silver touched a record level of $64.64 per ounce. The upward march continued, rising to over $72 per ounce at the time of writing (December 24, 2025), marking its highest level for the year and gaining 147% since the start of the year.

Although gold shone brightly, rising more than 70% since the beginning of 2025, driven by geopolitical tensions, interest rate cuts, strong central bank purchases, and robust investment demand, its luster seemed dimmer compared to silver’s extraordinary ascent.

These figures reflect a notable shift in investor appetite and raise deeper questions about the nature and limits of this rally, most importantly:

- What are the reasons behind silver’s stunning performance?

- Is what we are witnessing just a temporary wave or the beginning of a new era for the white metal?

- The most important question: how high could silver prices go in 2026?

This is what we will try to answer in this report…

What are the reasons for silver’s stunning performance?

December was only the third time in the past 50 years that silver prices have peaked. Among the other highest silver price levels were in January 1980, when the Hunt brothers attempted to corner the market, and in 2011, following the financial crisis when silver and gold were sought as safe havens.

Unlike previous investment waves, silver’s boom in 2025 relied on a combination of low supply, high demand, industrial needs, trade tensions, and geopolitical tensions worldwide.

6 Key Reasons

The reasons for the rise in silver prices in 2025 can be summarized into 6 key reasons according to a number of specialized economic platforms.

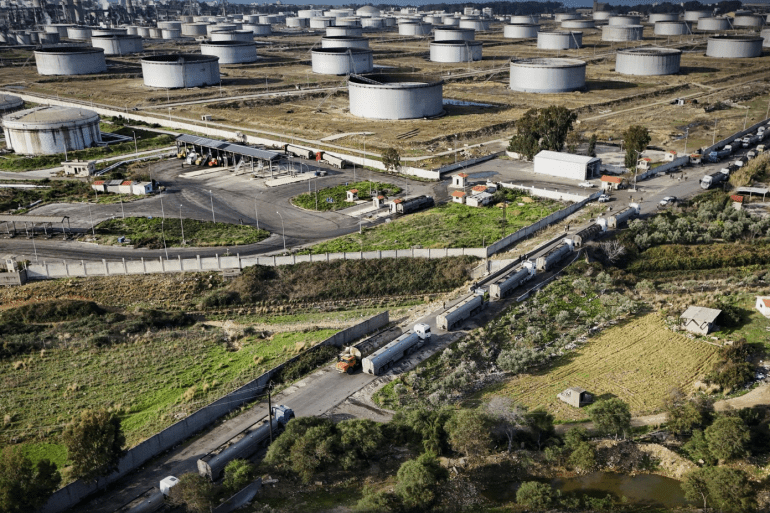

1- Global supply shortages and persistent supply deficit

The silver market has suffered from a persistent structural deficit for years, due to strong demand from industrial and investment sectors against limited capacity to increase production.

It is noted that the market “has been in deficit for the past five years, with ongoing disruptions in regional inventories,” reflecting the depth of the imbalance between supply and demand.

2- Increased industrial demand linked to modern technologies

Despite traditional uses of silver in jewelry and coin making, industrial demand has become the main driver of its consumption growth and price increases, particularly in the electronics and solar panel sectors.

This shift has increased pressure on the market, especially since silver is mostly produced as a by-product of other metals, limiting mining companies’ ability to respond quickly to rising demand and keeping supply under constant pressure.

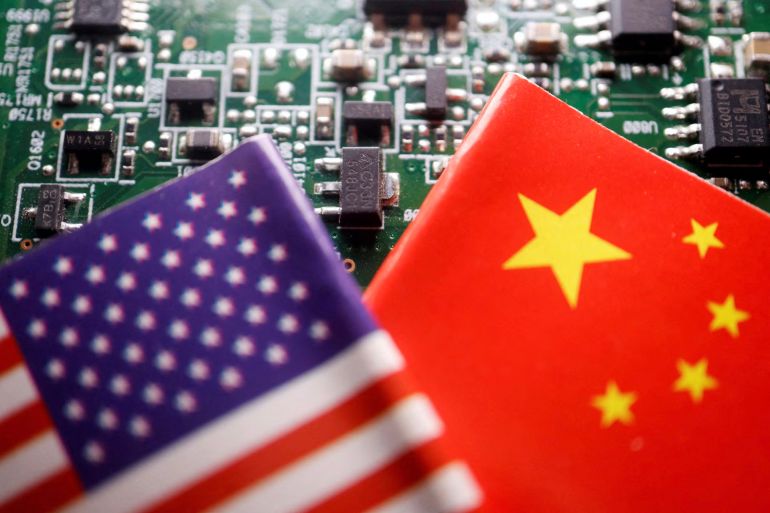

In the same context, silver has become an essential element in building data centers and manufacturing electric vehicles, two sectors that saw accelerated growth last year, boosting demand for the white metal and pushing its prices to higher levels.

3- Investor shift towards safe havens due to economic conditions

Interest rate cuts, alongside economic instability, geopolitical tensions in the Middle East, ongoing trade wars, and recently the Venezuelan oil crisis, have driven investors towards silver as an effective hedge against inflation and dollar weakness.

4- Strong investment flows into silver-backed exchange-traded products

With rising prices, silver-backed exchange-traded products recorded significant inflows, attracting more than 187 million ounces this year, an 18% increase from 2024 levels, contributing to intensifying the upward momentum.</