Tripoli, December 28, 2025 — A meeting was held today, Sunday, by the Banking and Monetary Control Department of the Central Bank of Libya with a number of general managers of commercial banks and directors of some specialized departments at the Central Bank. The meeting focused on organizing and developing the work of exchange companies and offices and enhancing coordination between them and the banking sector.

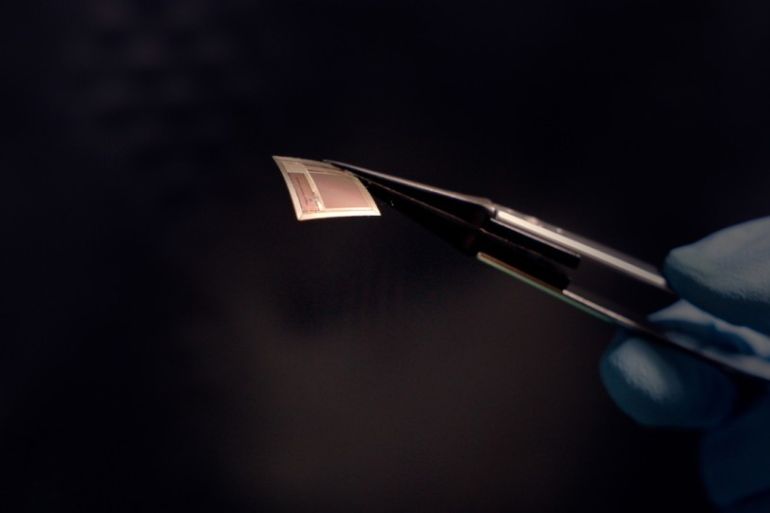

The meeting discussed mechanisms for regulating the operations of exchange companies and offices that have obtained activity licenses from the Central Bank of Libya. This is in preparation for them to commence their work in accordance with approved controls and instructions, as well as the mechanism for interaction between commercial banks and exchange companies and offices, particularly concerning the execution of rapid cash transfers through the Western Union and MoneyGram systems.

The attendees reviewed sources for funding the foreign currency accounts of exchange companies and offices, alongside studying the required procedures to allow these companies and offices to execute direct transfers through the accounts opened for them at commercial banks. This aims to ensure compliance with regulatory controls and anti-money laundering and counter-terrorism financing standards.

The discussion also touched upon the technical systems to be adopted by exchange companies, commercial banks, and the Central Bank of Libya to implement the proposed operational mechanism and ensure its integration and the integrity of its operational and oversight procedures.

This meeting is part of preparations for a planned meeting with exchange companies and offices next week to complete discussions on related regulatory and technical aspects.

In this context, authorization was granted for banks and exchange companies and offices to begin taking the necessary steps to activate the operational mechanism for executing rapid cash transfers via the MoneyGram and Western Union systems, in accordance with the controls and instructions issued by the Central Bank.